April 23, 2020

COVID-19 Could Increase US Inequality

A growing number of Americans can’t pay their rent, and the queues forming outside food banks hint at human need on the scale of the Depression. For Americans who were already living paycheck to paycheck prior to the pandemic, the $1,200 relief checks the government has deposited into their bank accounts are too little and came too late.

Few are being spared the financial fallout from the COVID-19 economic contraction. But economists predict the damage being done to working and middle class people will cause another surge in U.S. inequality, just as the previous recession did.

The big unknown is whether this downturn, which is unfolding more violently than the previous one, will do even more damage to livelihoods and produce an even bigger increase in inequality. Some economists say the unemployment rate is approaching 20 percent – double the peak reached in 2009.

New York University’s Edward N. Wolff, who has studied inequality for decades, predicts wealth inequality will spike again within the next two years. In the last recession, wealthy people lost money in the stock market, but the middle class did much worse.

The typical U.S. household’s net worth – their assets minus their debts – plunged by 44 percent between 2007 and 2010. This ended a 15-year period of stability relative to wealthier households, pushing inequality to historic highs.

The vulnerability in middle America’s finances back then remains a vulnerability today: debt. The Federal Reserve Bank of New York was already reporting early signs of growing financial distress among credit card borrowers prior to the current contraction, and Wolff said that the ratio of debt to net worth in the middle class is currently higher than it is for other groups. This debt, when combined with a fall in investment portfolios and an expected decline in house prices, will push up wealth inequality, he said.

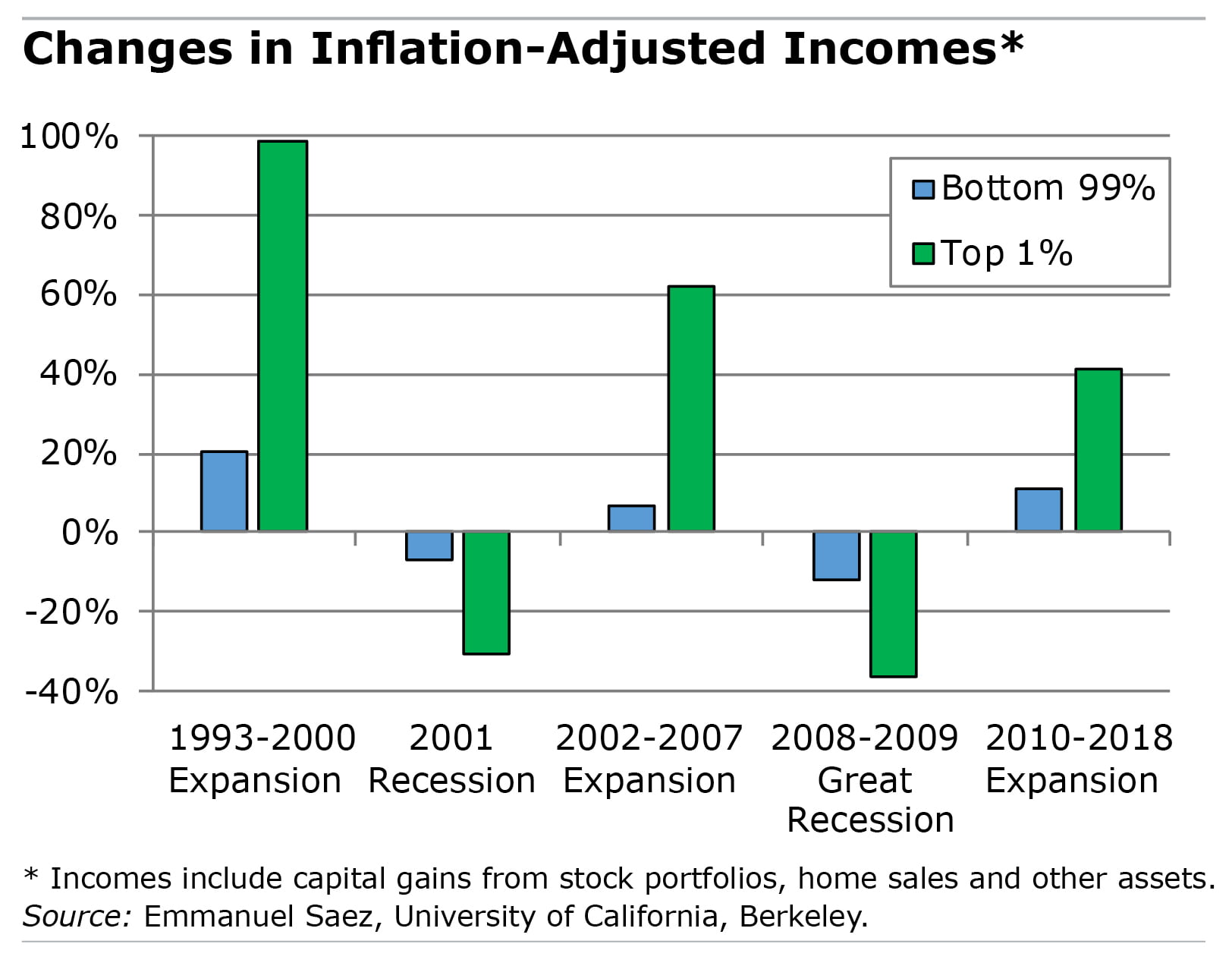

Another form of inequality – the disparity in incomes – widened after the last recession and Boston College economist Geoffrey Sanzenbacher worries that it will increase again. Between 2008 and 2018, the top 1 percent of U.S. families received nearly half of the increase in incomes for all U.S. families, adjusted for inflation.

Another form of inequality – the disparity in incomes – widened after the last recession and Boston College economist Geoffrey Sanzenbacher worries that it will increase again. Between 2008 and 2018, the top 1 percent of U.S. families received nearly half of the increase in incomes for all U.S. families, adjusted for inflation.

Sanzenbacher, who writes a blog about inequality, said that what distinguishes the current downturn from the 2008 recession explains why income inequality could go up this time around.

After the 2008 financial crisis, millions of the Americans who lost their jobs were relatively well-paid professionals in finance and business services who could scrape together enough money to weather the downturn. Of course, lower-income workers were laid off too. But the current contraction has hit lower-paid service workers first and hardest in industries like travel, restaurants and retail.

They often work for small businesses, which employ half of all U.S. workers. As the country pulls out of the coronavirus shutdown, “my biggest fear is that small employers don’t make it,” Sanzenbacher said.

The workers in these industries, who are disproportionately women, minorities, and immigrants, are the least able to handle losing their wages.

Read more blog posts in our ongoing coverage of COVID-19.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

I’m a professional writer with over 10 years of experience in the crypto industry. I have written for numerous publications, includingCoinDesk, Crypto Briefing, and The Block. My work has been featured in Forbes, Business Insider, and Huffington Post. I’m also a thought leader in the space and my insights into the industry are highly appreciated by readers worldwide.

43 Replies to “COVID-19 Could Increase US Inequality”

Comments are closed.